The outbound investment advisory service has become an indispensable component in today’s context of global economic integration. With the expansion of international markets, investors not only have opportunities to diversify and grow their investment capital but also face numerous legal, tax, and compliance challenges, as well as risks arising from cultural and market differences. BKC Law’s outbound investment advisory service serves as a trusted companion, providing optimal solutions to help investors make investment decisions that are both highly beneficial and safe.

Pursuant to Clause 13, Article 3 of the Law on Investment 2020, outbound investment is defined as “the act of an investor transferring investment capital from Vietnam to a foreign country and using the profits earned from such capital to conduct investment and business activities abroad.”

Outbound investment advisory refers to activities supporting enterprises in identifying competitive advantages when investing in key sectors of a foreign country, while helping new investors avoid unnecessary risks.

See also: 6 steps to prepare for outbound investment

Pursuant to Clause 1, Article 52 of the Law on Investment 2020, investors wishing to conduct direct outbound investment may do so through the following forms:

See also:

Company incorporation in Singapore

Company incorporation in the U.S.: Conditions, procedures, and updated costs

Pursuant to Article 60 of the Law on Investment 2020, Vietnamese enterprises intending to invest abroad must satisfy the following conditions:

Key information to be prepared includes:

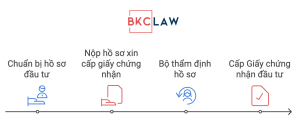

To obtain the Outbound Investment Registration Certificate, investors shall proceed as follows:

Step 1: Preparation of application dossier

According to Article 61 of the Law on Investment 2020:

For investment projects subject to outbound investment policy approval, the Ministry of Planning and Investment (MPI) shall issue the Outbound Investment Registration Certificate within 05 working days from receipt of the written approval of the investment policy and the outbound investment decision pursuant to Article 59.

For projects not subject to policy approval, investors shall submit the application dossier to MPI, including:

For outbound investment projects in sectors specified under Clause 1, Article 54, investors must submit written approval from the competent authority confirming that the investment conditions are met (if applicable).

Step 2: Submission of the application for the Outbound Investment Registration Certificate to MPI.

Step 3: Appraisal of the dossier by MPI.

Step 4: Issuance of the Outbound Investment Registration Certificate.

If the application is refused, a written explanation must be provided.

Step 1: The investor submits (in person or by post) 01 application dossier for registration of foreign exchange transactions to the State Bank of Vietnam (SBV).

Step 2: If the dossier is incomplete, within 05 working days from receipt, SBV will request additional documents.

Step 3: Within 10 working days from receipt of a complete dossier, SBV will confirm or refuse the registration. In case of refusal, SBV must state the reason in writing.

Dossier for registration of foreign exchange transactions includes:

See full details here:

Procedure for registering foreign exchange transactions related to outbound investment

Conditions for transferring outbound investment capital

First, the investor must have been issued the Outbound Investment Registration Certificate.

Second, the project must be approved by the competent authority of the host country. If the host country does not require investment approval, the investor must have documents proving the right to conduct investment activities.

Third, the investor must have a capital account pursuant to Article 63 of the Law on Investment.

Fourth, the investor shall be responsible for ensuring lawful, timely, and purpose-specific capital transfers, in compliance with petroleum contracts, share purchase agreements, etc.

Fifth, capital transfers must be made through the outbound investment capital account after SBV confirms the registration of foreign exchange transactions.

After preparing the reporting documents, investors may submit them via either of the following methods:

Report contents include:

See also:

Investment Registration Certificate amendment service

Corporate legal advisory services

BKC Law’s outbound investment registration service provides a comprehensive suite of specialized legal solutions supporting individuals and organizations intending to invest abroad.

Legal advisory: BKC Law provides comprehensive advice on regulations, procedures, and conditions for outbound investment.

Registration and licensing: Assisting clients with investment registration, preparation of application dossiers, and licensing procedures with competent authorities.

Contract drafting and negotiation: Drafting and reviewing contracts and agreements related to outbound investment to ensure legal compliance.

Dispute resolution: Supporting clients in resolving legal disputes arising during the investment process or when terminating an overseas investment project.

BKC Law is committed to providing effective and tailored legal solutions to help clients confidently expand their business and investment activities into international markets.

For further assistance and outbound investment advisory from BKC Law’s attorneys, please contact:

Phone: 0901 3333 41

Email: info@bkclaw.vn

Facebook: https://www.facebook.com/luattrunghieubkc

LinkedIn: https://www.linkedin.com/company/103064761

District 1 Office: 9th Floor, Diamond Plaza, 34 Lê Duẩn, District 1, Ho Chi Minh City

Binh Tan Office: 41 Tên Lửa, Bình Tân District, Ho Chi Minh City

Not found

0 (0) Currently, in Ho Chi Minh City, will drafting services are increasingly in demand to meet the growing need...

0 (0) Drafting a Will is a crucial step to protect your rights and those of your family, while ensuring...

0 (0) Investing in Industrial Parks in Vietnam has emerged as an attractive opportunity for both domestic and foreign investors....

0 (0) Declaration of Inheritance is an important legal procedure that confirms ownership rights to assets inherited by heirs following...

0 (0) Will Drafting Services provide a professional solution to express your wishes and legally protect your assets. Drafting a...

0 (0) The law office specializing in land law consultation is a provider of professional and dedicated legal services to...

0 (0) Conditions for Establishing a Foreign-Invested Company in Vietnam encompass the legal requirements and procedures that investors must comply...

0 (0) The law office services in Binh Tan District aim to support clients in ensuring their legal rights and...

0 (0) In recent years, with an increasingly improved business environment and more comprehensive investment support policies, Vietnam has become...

0 (0) A professional and highly experienced team of attorneys specializing in corporate law consultation services in Binh Tan District...

0 (0) Vietnam is currently attracting significant interest from foreign investors establishing companies in the country, thanks to its growing...

0 (0) Investment consulting services in Vietnam are increasingly affirming their essential role in supporting investors—from individuals to organizations—in achieving...

0 (0) Divorce is a complex process that often causes significant stress for the parties involved. Fast divorce services provided...

0 (0) The attorney retainer fee for initiating a lawsuit typically ranges from VND 1,000,000 to VND 5,000,000 per case....

0 (0) The land law consulting office provides professional and dedicated legal services for all clients. With a team of...

0 (0) When confronting inheritance matters, understanding the fees for engaging a professional inheritance attorney is essential to safeguarding your...

0 (0) Establishing a Chinese company in Vietnam is becoming a trend as more and more Chinese investors see the...

41 Rockets, Binh Tri Dong B, Binh Tan District, Ho Chi Minh City.

info@bkclaw.vn

0901 3333 41

9th Floor, Diamond Plaza Building, 34 Le Duan, Ben Nghe Street, District 1, Ho Chi Minh City.

info@bkclaw.vn

0901 3333 41