In recent years, with an increasingly improved business environment and more comprehensive investment support policies, Vietnam has become an attractive destination for foreign investors to establish FDI companies in Vietnam. The establishment of a joint-venture company (FDI) in Vietnam not only requires a thorough understanding of legal regulations but also accurate assessment of opportunities and challenges arising from the local business environment. As professional legal advisors, we are committed to providing up-to-date information and optimal investment strategies to help clients achieve sustainable success in investing and developing in the Vietnamese market.

According to current legislation under the Law on Investment 2020, there is no specific definition of foreign-invested enterprises (FDI). Instead, the law introduces the concept of foreign-invested economic organizations under Article 3, which provides:

“Foreign-invested economic organization means an economic organization with foreign investors as its members or shareholders.”

Accordingly, a foreign-invested enterprise is one form of foreign-invested economic organization, regardless of the percentage of foreign capital contributed. Foreign direct-investment enterprises include:

– Enterprises with 100% foreign capital.

– Enterprises in which foreign individuals or organizations established under foreign laws invest (capital contribution, capital acquisition).

Related articles:

Establishing a branch of a foreign company in Vietnam

Tax policies for 100% foreign-owned enterprises

To establish an FDI enterprise, investors must ensure that they meet the following conditions:

Pursuant to Article 22 of the Law on Investment 2020:

Foreign investors establishing an economic organization must satisfy the market-access conditions applicable to foreign investors set out under Article 9 of this Law.

Before establishing the economic organization, foreign investors must have an investment project and carry out procedures for issuance or adjustment of the Investment Registration Certificate, except for cases involving the establishment of small and medium-sized innovative start-up enterprises or innovative start-up investment funds under regulations on SME support.

Foreign investors contributing capital, purchasing shares, or acquiring capital contributions in an economic organization must satisfy the following:

In addition, under Decree 31/2024/NĐ-CP, the State also provides a list of sectors and conditions on market access applicable to foreign investors.

Eligible foreign investors may include individuals above 18 years of age, organizations, and enterprises of WTO member states or nations that have signed bilateral investment treaties with Vietnam. However, certain business sectors allow only foreign investors who are legal entities to participate. Individual investors holding passports with the “nine-dash line” content are prohibited from contributing capital or acting as authorized representatives managing foreign investment portions in Vietnam.

There is no specific regulation restricting investor nationality. Investors from any country may invest in Vietnam provided that they comply with applicable laws and international treaties to which Vietnam is a party.

Detailed provisions on subjects and nationality of foreign investors can be found in the Law on Enterprises, the Law on Investment, and other relevant regulations governing foreign investment in Vietnam.

Foreign investors must possess adequate financial capacity for investment activities and must submit evidence of financial capability depending on the chosen investment sector.

Foreign investors must secure a project implementation site in Vietnam through a location lease contract, house/land lease agreement, or other lawful property documents to serve as the company’s headquarters and project location.

For manufacturing projects, investors must demonstrate eligibility to lease factories and provide a factory lease agreement in industrial parks or clusters.

Foreign investors establishing FDI companies in Vietnam must satisfy sector-specific conditions applicable to conditional business sectors.

Additionally, foreign investors must ensure that they do not fall within prohibited business sectors under Article 6 of the Law on Investment 2020, including:

In Vietnam, foreign investors can establish FDI enterprises via two methods: direct investment and indirect investment, each subject to specific conditions:

– For direct investment, foreign investors establishing companies with foreign capital or 100% foreign-owned companies must satisfy conditions under Article 22 of the Law on Investment 2020.

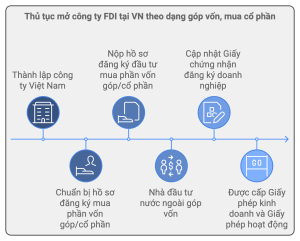

– For indirect investment, investors contribute capital or acquire shares/capital contributions in a Vietnamese company (in simple terms: a company is first established with 100% Vietnamese capital, then shares are transferred to foreign investors). Conditions for this type of investment are provided under Article 24(2) of the Law on Investment 2020.

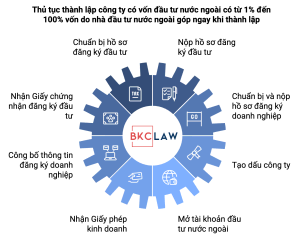

Step 1: Prepare documents for the Investment Registration Certificate

To obtain the Investment Registration Certificate (IRC), foreign investors must prepare:

Depending on investor type:

Step 2: Submit the application for the Investment Registration Certificate

For projects not subject to investment policy approval:

Step 3: Issuance of the Investment Registration Certificate

Within 15 working days from the date of receiving a complete application, the competent authority will issue the IRC. If the application is rejected, the authority must respond in writing with clear reasons.

Step 4: Prepare and submit documents for the Enterprise Registration Certificate (ERC) to establish the FDI company

After receiving the IRC, investors must apply for the ERC similar to establishing a Vietnamese-owned company.

ERC documents include:

Step 5: Publish enterprise registration information

After being granted the ERC, the company must publicly disclose information through the National Business Registration Portal and pay the publication fee.

Published information includes business sectors, list of founding shareholders, and foreign shareholders (if applicable).

Failure to publish or publishing incorrect information is subject to penalties under Decree 122/2021/NĐ-CP.

Step 6: Company seal engraving

The seal may be a physical seal or a digital signature. The enterprise decides seal quantity, type, form, and content.

Seal management follows the company charter or internal regulations.

Step 7: Obtain business licenses or operational permits

Business licenses are required for retail activities or establishing retail outlets. Some sectors require specialized permits such as food safety, environmental permits (food sector), education licenses, travel licenses, etc.

Conditions for obtaining a retail business license include:

· Having a financial plan;

Other considerations:

Process for retail business license application:

Processing time: approximately 30–45 working days by the Department of Industry and Trade.

Step 8: Open a direct investment capital account

This account is used to transfer contributed capital on schedule as stated in the IRC. The FDI company must also open a transaction account for local payments.

Step 1: Establish a Vietnamese-owned company

Foreign investors can acquire shares only when a Vietnamese company exists. If the Vietnamese partner has not completed company establishment procedures, they must first establish a 100% Vietnamese-owned enterprise.

Step 2: Prepare the application for capital contribution/share acquisition

Required documents include:

Not found

0 (0) In Ho Chi Minh City, specifically Inheritance Disputes in Binh Tan District represent a frequently encountered legal issue,...

0 (0) Resolution of Land Disputes in Binh Tan District is a matter of significant concern amid the rapid urbanization...

0 (0) <em><span id=”cke_bm_306S”> </span><strong>Resolution of Disputes Arising from Condominium Purchase and Sale in Binh Tan District</strong> is a prevalent legal...

0 (0) Currently, in Ho Chi Minh City, will drafting services are increasingly in demand to meet the growing need...

0 (0) Drafting a Will is a crucial step to protect your rights and those of your family, while ensuring...

0 (0) Investing in Industrial Parks in Vietnam has emerged as an attractive opportunity for both domestic and foreign investors....

0 (0) Declaration of Inheritance is an important legal procedure that confirms ownership rights to assets inherited by heirs following...

0 (0) Will Drafting Services provide a professional solution to express your wishes and legally protect your assets. Drafting a...

0 (0) The law office specializing in land law consultation is a provider of professional and dedicated legal services to...

0 (0) Conditions for Establishing a Foreign-Invested Company in Vietnam encompass the legal requirements and procedures that investors must comply...

0 (0) The law office services in Binh Tan District aim to support clients in ensuring their legal rights and...

0 (0) A professional and highly experienced team of attorneys specializing in corporate law consultation services in Binh Tan District...

0 (0) Vietnam is currently attracting significant interest from foreign investors establishing companies in the country, thanks to its growing...

0 (0) Investment consulting services in Vietnam are increasingly affirming their essential role in supporting investors—from individuals to organizations—in achieving...

0 (0) Divorce is a complex process that often causes significant stress for the parties involved. Fast divorce services provided...

0 (0) The attorney retainer fee for initiating a lawsuit typically ranges from VND 1,000,000 to VND 5,000,000 per case....

0 (0) The land law consulting office provides professional and dedicated legal services for all clients. With a team of...

0 (0) When confronting inheritance matters, understanding the fees for engaging a professional inheritance attorney is essential to safeguarding your...

0 (0) The outbound investment advisory service has become an indispensable component in today’s context of global economic integration. With...

0 (0) Establishing a Chinese company in Vietnam is becoming a trend as more and more Chinese investors see the...

41 Rockets, Binh Tri Dong B, Binh Tan District, Ho Chi Minh City.

info@bkclaw.vn

0901 3333 41

9th Floor, Diamond Plaza Building, 34 Le Duan, Ben Nghe Street, District 1, Ho Chi Minh City.

info@bkclaw.vn

0901 3333 41