The full-service company formation service is reliable and fast, offering comprehensive solutions to help clients complete all procedures for establishing a business quickly and efficiently. With a team of experienced experts, the service supports clients from choosing the type of company, registering the business, drafting legal documents, to completing necessary procedures to ensure the company can legally operate. Every step is aprofessionally executed, saving time and costs to the maximum extent.

Step 1: Receive Information & Initial Consultation

Receive requests from clients.

Advise on the suitable business model (Limited Liability Company, Joint Stock Company, Sole Proprietorship…).

Explain the legal rights and obligations of the business.

Guide the client in preparing the necessary information.

Step 2: Draft Business Registration Documents

Prepare the company formation documents according to legal requirements, including:

Business registration application form.

Company charter.

List of members/shareholders (if any).

Copies of legal documents of the legal representative and contributing members.

Send the documents to the client for review and signature.

Step 3: Submit Documents & Receive Business Registration Certificate

Represent the client in submitting the documents to the Department of Planning and Investment.

Monitor the document processing status and make amendments if additional documents are requested.

Receive the Business Registration Certificate (BRC) and send it back to the client.

Step 4: Company Seal & Publicize Company Information

Carry out the company seal procedure (round seal, position seal if necessary).

Publicize the company’s information on the National Business Registration Portal.

Step 5: Complete Post-Formation Procedures

Support registering a bank account and notifying the Department of Planning and Investment.

Guide on printing and issuing electronic invoices.

Register for digital signatures and initial tax declaration.

Advise on labor and social insurance procedures (if necessary).

Step 6: Hand Over Documents & Post-Formation Legal Support

Hand over all related documents and files to the client.

Provide free legal support during the early stages of company operation.

BKC Law provides a full-service company formation service with a fast, professional process at reasonable costs. Below is a reference price list for the full-service company formation at BKC Law:

| Service Package | Cost (VND) | Completion Time | Included Services |

|---|---|---|---|

| Basic Package | 2,000,000 – 3,000,000 | 5 – 7 working days | – Business model consultation – Drafting and submitting business registration documents – Receiving the Business Registration Certificate – Company seal |

| Standard Package | 4,000,000 – 5,000,000 | 5 – 7 working days | – Includes Basic Package – Publicizing company information – Registering tax code – Assisting in opening a business bank account |

| Advanced Package | 6,000,000 – 8,000,000 | 7 – 10 working days | – Includes Standard Package – Registering digital signature (Token) – Guiding the issuance of electronic invoices – Assisting in social insurance registration |

| VIP Full Package | 9,000,000 – 12,000,000 | 7 – 10 working days | – Includes Advanced Package – Assisting with initial tax declaration – Registering for VAT invoices – Free legal consultation for 6 months post-formation |

Note: The above prices are for reference only and may change depending on the type of business and specific customer requests. For an accurate quote, please contact BKC Law directly.

When using company formation services at BKC Law, clients need to provide the following information and documents:

Business Information:

Type of business: Single-member LLC, Multi-member LLC, Joint Stock Company, Sole Proprietorship, or Individual Business.

Company name: Full name and abbreviated name (if any), following legal naming rules.

Head office address: A valid address, cannot be in an apartment building (unless the building is designated for business purposes).

Business activities: List of business activities to be registered, ensuring compliance with legal regulations.

Charter capital: Initial contribution amount, affecting the company’s financial liability.

Owner/Member/Shareholder Information:

Full name, date of birth.

Nationality.

Permanent address and contact address.

ID card/Passport (notarized copy, valid).

Capital contribution ratio of each member/shareholder (for multi-member LLCs and joint-stock companies).

Legal Representative Information:

Full name, date of birth.

ID card/Passport (notarized copy).

Position in the company (Director/CEO/Chairman…).

Other Information (if any):

Intended use of electronic invoices.

Decision on using a digital signature (Token) for tax filing.

Requirement to open a business bank account.

Note: BKC Law will provide detailed consultation to help clients complete all information according to legal requirements. All documents provided must be notarized within the last 6 months.

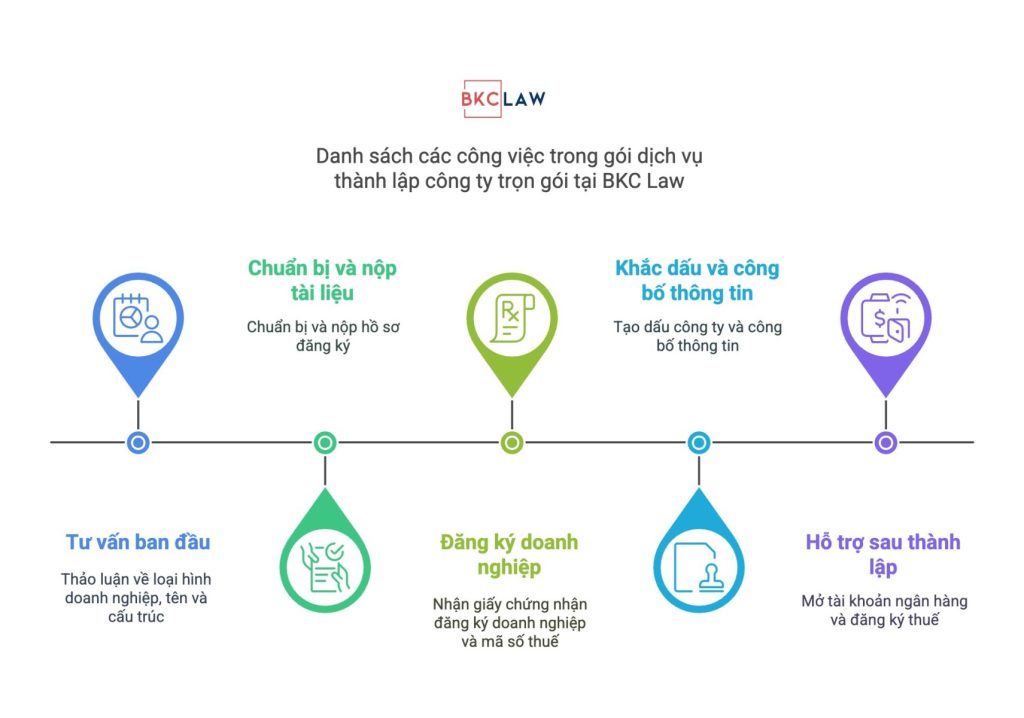

Here is a list of tasks included in the full-service company formation package at BKC Law:

Pre-Formation Consultation:

Business model, company name, head office address.

Charter capital, business activities, and capital structure.

Drafting Documents & Business Registration:

Prepare and submit the documents to the Department of Planning & Investment.

Receive the business registration certificate and tax code.

Seal and Publicize Information:

Company seal, position seals.

Publicize the company’s information on the National Business Registration Portal.

Post-Formation Support:

Open a bank account, register digital signatures, and electronic invoices.

Register for initial tax filing, social insurance (if necessary).

Note: Services may vary depending on the chosen package. Contact BKC Law for detailed consultation!

Depending on the type of business, the registration documents will have different requirements. Below is the list of documents required for each business type according to current regulations.

Documents for Establishing a Single-Member LLC:

Business registration application.

Company charter (signed by the owner).

Notarized copy of ID card/Passport of the owner.

Power of attorney (if authorization is given to another individual/organization).

Legal documents of the authorized individual/organization (if any).

Documents for Establishing a Multi-Member LLC:

Business registration application.

Company charter, signed by all members.

List of members according to the prescribed form.

Notarized copy of ID card/Passport of each member.

Power of attorney (if any).

Notarized copy of ID card/Passport of the legal representative.

Legal documents of the authorized individual/organization (if any).

Documents for Establishing a Joint Stock Company:

Business registration application.

Company charter, signed by all founding shareholders.

List of founding shareholders.

Notarized copies of ID card/Passport of each founding shareholder.

Notarized copy of ID card/Passport of the legal representative.

Power of attorney (if any).

Legal documents of the authorized individual/organization (if any).

Documents for Establishing a Sole Proprietorship:

Business registration application.

Notarized copy of ID card/Passport of the owner.

Company charter (if any).

Power of attorney (if authorization is given).

Legal documents of the authorized individual/organization (if any).

Documents for Establishing an Individual Business:

Business registration application.

Notarized copy of ID card/Passport of the business owner.

Company charter (if any).

Power of attorney (if authorization is given).

Legal documents of the authorized individual/organization (if any).

General Notes:

Personal documents (ID card/Passport) must be notarized within the last 6 months.

The company’s head office address must be valid, cannot be in an apartment building unless it is designated for business.

Documents can be submitted online through the National Business Registration Portal or directly at the Department of Planning & Investment.

Company formation is an important step that requires compliance with legal regulations to avoid risks and save time. With years of experience in business consulting, BKC Law commits to offering professional, transparent, and efficient services to help businesses get started smoothly.

Deep, Dedicated Consultation:

The team of experienced lawyers and professionals will help clients choose the suitable business type (LLC, Joint Stock Company, Sole Proprietorship, Individual Business…).

Guide clients on the correct company name, address, charter capital, and appropriate business activities.

Quick, Accurate Procedures:

BKC Law directly handles the entire process of preparing documents, submitting them to the Department of Planning & Investment, and following up on results.

Commit to completing the procedures within 5 – 7 working days, enabling the business to operate quickly.

Ensure documents are correct from the first submission, minimizing cases of return due to errors.

Reasonable, Transparent Costs:

Provide flexible service packages, from basic to premium, to suit each client’s needs.

No hidden costs, clear pricing from the start.

Help clients minimize costs while ensuring all necessary legal procedures are completed.

Post-Formation Full Support:

Assist in opening a bank account, registering a digital signature (Token), and issuing electronic invoices.

Support in initial tax filing, social insurance registration (if necessary).

Consult on tax filing procedures and financial reporting to ensure the business operates in compliance with regulations.

Choosing a service provider for company formation has a significant impact on the process and the future success of the business. Below are some important factors to consider to ensure you choose a reputable advisory firm that suits your needs.

Evaluate the Reputation and Experience of the Service Provider

Research the experience and reputation of the advisory firm through their website, customer reviews, and social media feedback. Choose a company with strong legal expertise, experienced lawyers, and specialists in the business field. Check if the firm offers a clear service contract that protects the client’s interests.

Examine Service Packages and Costs

Understand the different service packages offered: basic, standard, advanced, VIP… to choose one that fits your needs. Carefully review the detailed pricing table to avoid hidden costs or unclear additional charges. Compare prices among different providers to ensure a reasonable fee while maintaining service quality.

Is the Service Comprehensive and Full-Service?

A reputable full-service company formation service should include:

Pre-establishment advice: Choosing the type of business, naming the company, defining business activities, and initial capital.

Drafting and submitting documents: Preparing and submitting the application to the Department of Planning and Investment, obtaining the business registration certificate.

Company seal and public information announcement.

Post-establishment support: Registering digital signatures, e-invoices, initial tax declarations, opening bank accounts.

Free legal consultations post-establishment to help the company comply with regulations.

Completion Time for Procedures

Check if the service provider guarantees a clear completion timeline. Typically, the process takes 5-7 working days, but delays may occur due to additional document requirements. Clarify any potential delays or complications that might affect the completion time.

Post-Establishment Legal Support Policies

Some firms only support you until the company gets its license but do not provide post-establishment assistance. Choose a firm that offers at least 3 to 6 months of free legal consultation after establishment to help your company operate within the legal framework. Check if the firm offers accounting and tax services, financial reporting, and social insurance if needed.

Clear Service Contract

Ask the advisory firm to provide a contract that clearly states the scope of work, costs, and timelines. Review the terms on the responsibilities of both parties, ensuring protection if issues arise.

Open a Bank Account and Register for E-tax Filing

Open a company bank account.

Register the bank account with the Department of Planning and Investment.

Register for e-tax filing via the bank.

Tax Registration and Fulfillment of Tax Obligations

Register initial tax filings with the tax authority.

Register a digital signature for e-tax filings.

Pay the business license tax within 30 days from the issuance of the Business Registration Certificate.

Choose the tax filing method (deductible or direct).

Issue e-invoices and notify the tax office about their issuance.

Display a Sign at the Company’s Headquarters

The company must have a sign displayed at its headquarters to avoid penalties during inspections.

Register Labor and Social Insurance (if applicable)

Sign labor contracts with employees (if any).

Register social insurance and health insurance for employees.

Prepare Accounting Books

Hire an accountant or use accounting services to comply with regulations.

Open accounting books and record financial transactions.

Obtain Sub-Licenses (if required)

If the business involves regulated activities (e.g., food service, education, healthcare), additional licenses may be required.

Who can establish a company?

Any individual or organization with full legal capacity can establish a company, except for those prohibited by law, such as government officials, soldiers, and individuals under 18.

What type of business entity should I choose?

Depending on your business needs, you can choose:

Sole proprietorship: Suitable for individual entrepreneurs with unlimited liability.

One-member LLC: One owner, limited liability.

Multi-member LLC: 2-50 members, limited liability.

Joint-stock company: At least 3 shareholders, easier capital mobilization.

Partnership: Less common, with members bearing unlimited liability.

How long does it take to establish a business?

If the documents are correct, the Department of Planning and Investment will issue the business registration certificate within 3-5 working days.

Do I need to prove the charter capital?

No, but the business owner must commit to contributing the full capital within 90 days of establishment. If contributing assets, supporting documents are required.

Does the company need to display a sign?

Yes, the company must display a sign at its headquarters to avoid fines during inspections.

Can I set up the business address in a house or apartment?

Yes, it can be a home address, but not in an apartment unless it’s designated for commercial use.

Is it necessary to open a bank account for the company?

Yes, the company must open a bank account and register it with the Department of Planning and Investment to carry out financial transactions.

Do I need to hire an accountant?

Not mandatory, but the company must ensure proper tax declarations. If no in-house accountant, you can use external accounting services.

When do I need to pay taxes after establishing the company?

The business must pay the business license tax within 30 days after receiving the business registration certificate. Other taxes are filed monthly or quarterly, depending on the regulations.

When can the company issue invoices?

The company must register for e-invoice use with the tax authority before issuing valid invoices to customers.

For free legal consultation at BKC Law, you can contact our lawyers using the following details:

Phone: 0901 3333 41

Email: info@bkclaw.vn

District 1 Office: 9th Floor, Diamond Plaza, 34 Lê Duẩn, District 1, Ho Chi Minh City

Binh Tan Office: 41 Tên Lửa, Binh Tan, Ho Chi Minh City

Related Articles:

Conditions for establishing a foreign-invested company

FDI Business is what? The most detailed process of establishing an FDI business in 2025

Legal advisory contract drafting services by Lawyers in Ho Chi Minh city

This article is intended to provide general information only and is not intended to provide any architectural solution ideas for any specific case. The legal regulations cited in the article were in effect at the time of posting but may have expired by the time you read it. BKC Law recommends that you consult a professional/lawyer before applying.

5 (1) FDI capital accounts are essential for foreign investors seeking to establish a business presence in Vietnam. According to...

0 (0) The 2020 Law on Investment introduced several significant updates to Vietnam’s legal framework for investment, streamlining the process...

5 (1) Adjusting the Investment Registration Certificate (IRC) is a crucial legal procedure for foreign-invested companies (FDI companies) operating in...

0 (0) Registering a foreign trademark in Vietnam is a critical step for international businesses and individuals aiming to enter...

5 (1) Exclusive trademark registration is a strategic step that helps businesses protect their legal rights, establish market position, and...

5 (1) Copyright registration is a critical step in protecting creative works and establishing legitimate ownership of literary, artistic, scientific...

5 (1) Copyright disputes often arise from unclear ownership rights over creative works, particularly when the parties involved lack clear...

5 (1) Vietnam’s retail sector has become an increasingly attractive destination for foreign corporations and international investors. With a population...

5 (1) Contributing capital to a foreign-invested company in Vietnam is a key activity amid increasing international economic integration. This...

5 (1) Establishing a Chinese-invested company in Vietnam is becoming a significant investment trend due to the growing economic relations...

0 (0) Establishing a Japanese company in Vietnam is a strategic choice pursued by many Japanese enterprises, especially as Vietnam...

0 (0) Foreign direct investment in Vietnam is growing rapidly, especially from Singapore. Enterprises from Singapore looking to do business...

0 (0) Korean company formation in Vietnam is becoming increasingly common due to the growing economic cooperation between Vietnam and...

5 (1) Vietnam remains an attractive destination for foreign investors, thanks to its open policies, deep global integration, and an...

5 (1) In the context of deep international economic integration, Vietnam continues to be one of the most attractive investment...

0 (0) Foreign enterprises wishing to do business in Vietnam must meet certain requirements in accordance with investment and commercial...

0 (0) In the current economic context, many foreign investors are seeking to establish businesses in Vietnam. Particularly, foreign individuals...

5 (1) A legal advisor for foreign-invested enterprises (FDI) acts as a legal architect—designing the operational foundation, safeguarding investor rights,...

5 (1) Currently, establishing a foreign-invested enterprise (FDI) in Vietnam requires investors to be well-prepared in terms of legal compliance,...

5 (1) Establishing a retail outlet in Vietnam is not a simple process for foreign investors. It requires compliance with...

0 (0) Vietnam entry visa service for Chinese citizens provides a fast and convenient solution for those who wish to...

5 (1) E-commerce business licenses are a mandatory requirement for individuals and organizations to legally operate in the e-commerce sector....

0 (0) The process of applying for sub-licenses for Chinese-invested companies in Vietnam is essential for businesses to operate legally...

5 (1) The establishment of a Macau-invested company in Vietnam presents an attractive opportunity for international investors, particularly from Macau,...

0 (0) Establishing a Japanese-invested company in Vietnam presents attractive business opportunities while strengthening economic ties between the two nations....

5 (1) Comprehensive business registration service for Chinese companies in Vietnam is the ideal solution for Chinese enterprises looking to...

0 (0) The procedure for establishing a Chinese company in Vietnam requires investors to comply with Vietnamese legal regulations. Currently,...

0 (0) Investing in industrial parks in Vietnam is becoming an attractive opportunity for both domestic and foreign investors, thanks...

5 (1) The conditions for establishing a foreign-invested company in Vietnam include legal requirements and procedures that investors must comply...

5 (1) Contract disputes over the sale of goods arise when buyers and sellers disagree on contract terms such as...

5 (1) In recent years, Binh Tan District has attracted a large number of residents from central areas looking to...

5 (1) Contract disputes over house purchases often arise due to unclear contract terms, lack of transparency in property information,...

0 (0) Resolving property disputes after divorce is a common legal issue that arises when the termination of a marriage...

5 (1) An inheritance dispute is a complex legal issue that arises when there is a disagreement among involved parties...

5 (1) A temporary residence card is one of the most important documents that allow foreigners to legally live and...

5 (1) When establishing a business, completing the initial tax registration procedure is one of the important factors that helps...

5 (1) Our all-inclusive service for foreign work permits in 2025 provides a comprehensive solution, helping businesses complete procedures quickly...

5 (1) A sub-license is an additional license that a business or individual needs to operate in certain conditional business...

5 (1) In the context of Vietnam becoming an increasingly attractive destination for foreign investors, FDI (Foreign Direct Investment) businesses...

5 (1) In recent years, the demand among overseas Vietnamese (Vietnamese citizens residing abroad and people of Vietnamese origin living...

0 (0) The growing demand for language education has made it increasingly important to establish a foreign language center. In...

5 (1) Work Visa services for foreigners in Ho Chi Minh City offers valuable opportunities for those seeking a career...

0 (0) Trademark registration services in Vietnam play a crucial role in protecting the intellectual property rights of businesses and...

5 (1) Intellectual property (IP) disputes have become an increasingly prominent issue in today’s digital era, as IP assets such...

5 (1) Franchising in Vietnam is experiencing a strong boom, reflecting the country’s rapid economic growth and shifts in consumer...

0 (0) Copyright registration is an essential step in protecting creative works from infringement and unauthorized copying. The registration process...

0 (0) Debt collection is a critical concern for many businesses, running parallel with their commercial activities. Through our extensive...

5 (2) With the current global economic integration, the issuance of work permits for foreign workers has become a major...

5 (1) Contract Drafting Consulting Services in Ho Chi Minh City are developing strongly, as contract drafting is a crucial...

5 (1) In today’s challenging business environment, having a private lawyer service for enterprises has helped investors navigate intense competition...

0 (0) The Investment Registration Certificate Amendment Service is a professional service designed to assist investors in modifying, supplementing, or...

3 (2) Issues related to procedures for applying for an overseas investment registration certificate are currently receiving a lot of...

5 (1) In recent years, with an increasingly improved business environment and more refined investment support policies, our country has...

5 (1) Currently, property disputes in general, and inheritance dispute resolution in particular, are increasingly common. In cases where both...

5 (1) Contract disputes in goods sales are inevitable issues in business operations between enterprises. When disputes cannot be resolved...

5 (1) Land disputes are among the most complex legal issues, directly affecting the rights and assets of the parties...

5 (1) To help our clients better understand the procedures and steps involved in resolving divorce disputes, BKC Law invites...

5 (2) To gain the clearest and most comprehensive perspective on commercial dispute resolution and to help parties understand and...

5 (1) Establishing a Chinese company in Vietnam is becoming a trend as more and more Chinese investors see the...

0 (0) Contract drafting consulting services in Ho Chi Minh City are being strongly developed because contract drafting is an...

0 (0) Facebook Comments Box How useful was this post? Click on a star to rate it! Submit Rating Average...

5 (1) Vietnam is becoming an attractive destination for international companies thanks to its fast-growing economy and favorable investment environment....

41 Ten Lua, Binh Tri Dong B, Binh Tan District, Ho Chi Minh City.

info@bkclaw.vn

0901 3333 41

9th Floor, Diamond Plaza Building, 34 Le Duan, Ben Nghe Street, District 1, Ho Chi Minh City.

info@bkclaw.vn

0901 3333 41